SCIENTIFIC RESEARCH AND EXPERIMENTAL DEVELOPMENT (SR&ED) AND OTHER FUNDING

POWERING YOUR BUSINESS INNOVATION, RESEARCH AND GROWTH THROUGH SMART FUNDING

MAXIMIZING YOUR FUNDING WITH SMART TECHNICAL, FINANCIAL AND TAX ADVICE

SGC Innovation Strategies is comprised of a group of highly skilled SR&ED tax credit and grants specialists. We assist businesses across Canada in preparing and submitting SRED tax credit applications and other grants and tax credits related to innovation, marketing and business development.

What sets us apart is our cross disciplinary in-house function with technical and financial / tax specialists. We will work with you on full cycle with dedicated 1-1 consultants who will maximize your claim through smart tax planning and build strong technical / scientific applications

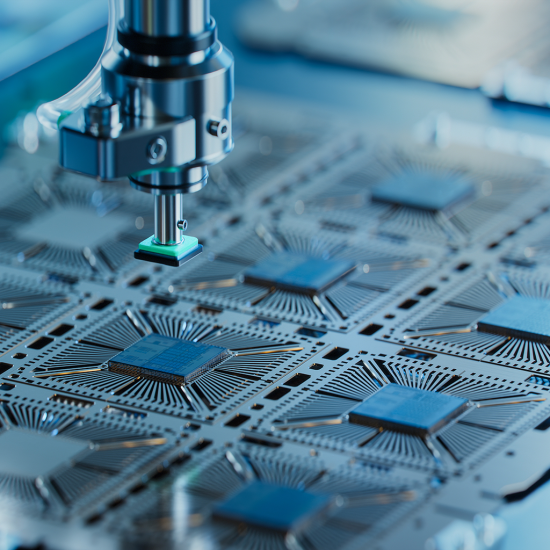

These tax credits and grants are open to any corporation who is making some advances in their technology or in science. Many different businesses are able to apply for these substantial government incentives and our practise covers many different industries including :

- Software and Computer Engineering

- Health Sector (including medical and dental specialisms, complementary medicine, medical devices, pharma)

- Construction (incl civil engineering)

- Food and Drink

- Production / Mechanical Engineering

- Manufacturing (plant design, fabrication, craft industries)

SR&ED TAX CREDITS, GRANTS, INNOVATION AND BUSINESS DEVELOPMENT INCENTIVES

STRATEGIC SR&ED TAX CREDITS FOR STRATEGIC THINKERS - An Introduction

GET IN TOUCH

CONTACT US

We’re here to help! Send any questions you have over to us, or schedule a consultation. We look forward to hearing from you.